Global stock markets and the value of bitcoin reached unprecedented levels in 2024, driven by investor optimism surrounding advancements in artificial intelligence, a decline in interest rates, and expectations of tax relief measures.

Here are four key characteristics of the financial markets for 2024:

Market prices decline consecutively.

US stock market indices set extraordinary heights, seeing the Dow Jones Industrial Average breach 45,000 points, the S&P 500 touch 6,000 and the Nasdaq Composite reach 20,000 in early 2024.

“It was a particularly noteworthy year, largely buoyed by the stellar showing of tech stocks, fueled by the rapidly advancing field of artificial intelligence,” stated Christopher Dembik, a senior investment expert at Pictet Asset Management.

The current market trends indicate that the Dow Index will finish the year with a gain of roughly 13%, as opposed to the S&P 500 and the Nasdaq, which are projected to post annual increases of just under 24% and 30% respectively, primarily due to their substantial investments in technological stocks.

Stocks in Nvidia, a company known for producing processors especially valued for their ability to support AI models including applications like ChatGPT, are expected to climb more than 175 percent by the end of 2024.

“It’s roughly 24 months since ChatGPT’s introduction to the market, and it has been two years that the AI phenomenon has driven major US tech firms to meteoric success,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

“Nvidia, currently the leading figure in the AI market, has surged by nearly 1,000 percent since then; the ‘Magnificent Seven’ stocks have also nearly doubled in value since last November,” she added.

Seven leading companies are highly regarded for their significant technological and consumer influence worldwide: Alphabet, Amazon, Apple, Meta Platforms (Facebook), Microsoft, Nvidia, and Tesla.

The record highs observed in Europe led to noticeable gains in comparison.

Frankfurt’s DAX index, spearheaded by business software leader SAP, rose above the 20,000-point mark, closing out the year with an 18.9% increase.

Tokyo’s Nikkei 225 index rose approximately 20 percent in 2024, ultimately outdoing the peak seen prior to Japan’s asset bubble collapse in the 1990s.

A very political year

Wall Street received a further boost after Donald Trump’s success in the US presidential election, buoyed by expectations that he will implement his promises of deregulation and tax cuts.

“It is anticipated that this move will lead to increased growth over a prolonged period,” stated Pierre Bismuth, Managing Director at Myria Asset Management.

Economic values often face difficulties under political leadership. A case in point is France, where Chancellor Emmanuel Macron called for early parliamentary elections, which ultimately resulted in a hung parliament with no clear winner. The Paris stock market, the CAC 40, significantly declined in 2024, ending the year with a loss of over two percent.

Chinese economic slowdown accelerated the decline of luxury sectors.

Investors are anxiously monitoring 2025 to see whether Donald Trump follows through on his threatened increase in tariffs and also closely watching the outcome of Germany’s upcoming February elections.

Bitcoin, gold and commodities

Bitcoin surged past expectations of deregulation under Trump, breaking the $100,000 barrier and increasing over 120 percent. Ethereum showed a significant rise of more than 40 percent, although it did not set a new all-time record.

Gold surged to a record high, capitalizing on its status as a sought-after safe-haven investment during periods of heightened geopolitical uncertainty.

Weaker global supplies of coffee and cocoa reached new highs due to adverse weather conditions.

Monetary policy roller coaster

Major Western central banks have now started to reduce interest rates they had initially increased to curb the inflation caused by a period of post-pandemic recovery and Russia’s invasion of Ukraine.

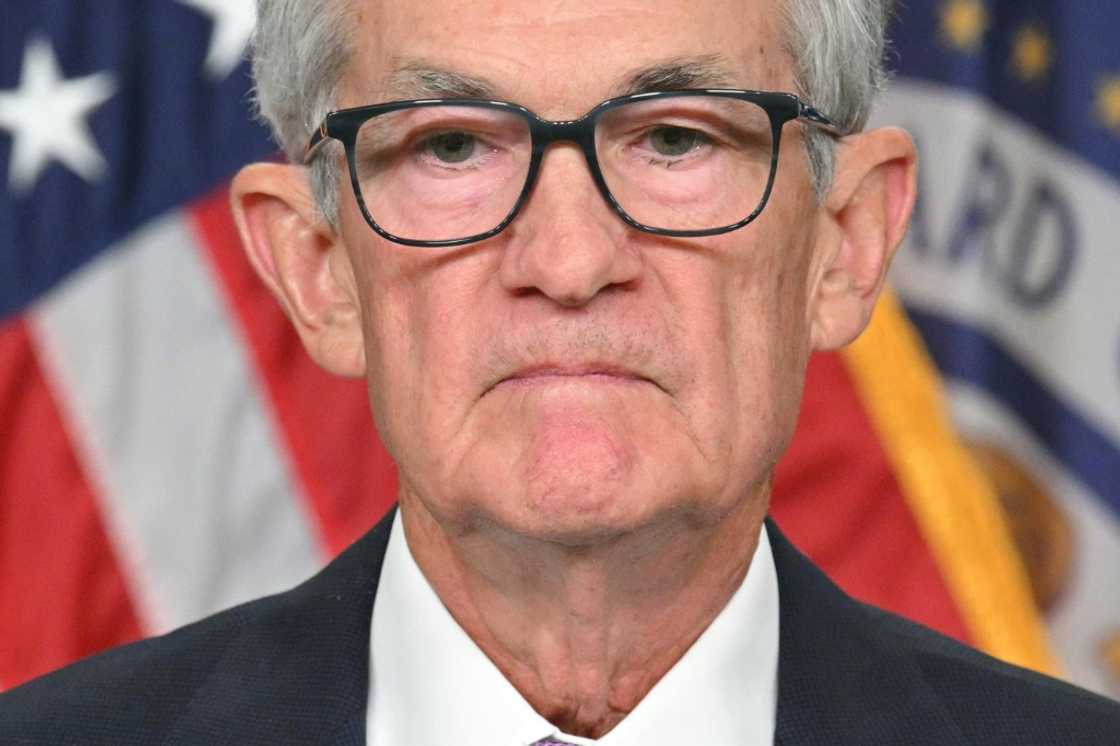

Switzerland led the charge in March, although its example was followed by the European Central Bank in June and by the Bank of England and the US Federal Reserve in September.

Market participants, including central banks, are uneasy about the frequency of interest rate reductions: Not too frequent to stoke price inflation, nor so infrequent to lead to reduced economic activity.

Market fluctuations arose as investors assessed economic data through the lens of its implications for the potential interest rate reduction by the Federal Reserve.

In August, investors became alarmed by disappointing US employment numbers, resulting in a nearly three percent decline on the Wall Street market as they feared an impending economic downturn.

The United States economy has shown resilience and investors and the Federal Reserve have begun to tone down their expectations for additional rate cuts, primarily due to concerns that President Trump’s tariffs could lead to increasing inflationary pressures.

The eurozone is not expected to see any significant economic improvement, prompting the European Central Bank (ECB) to likely continue reducing interest rates.